Debt Settlement

Debt Settlement

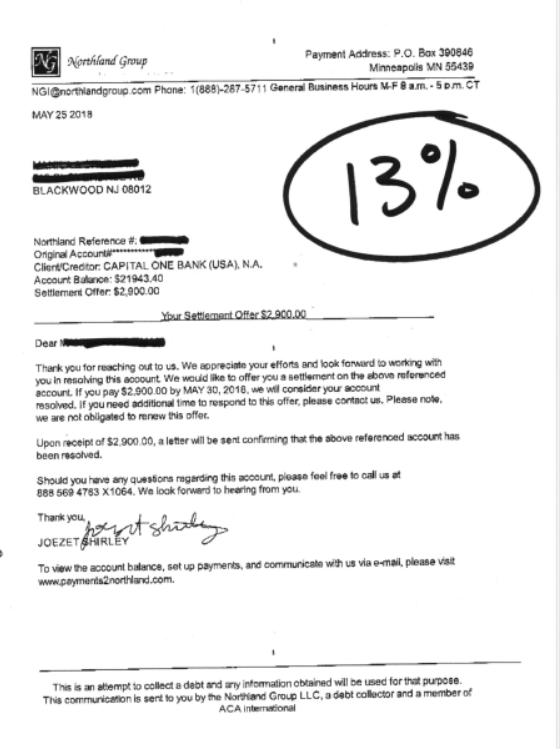

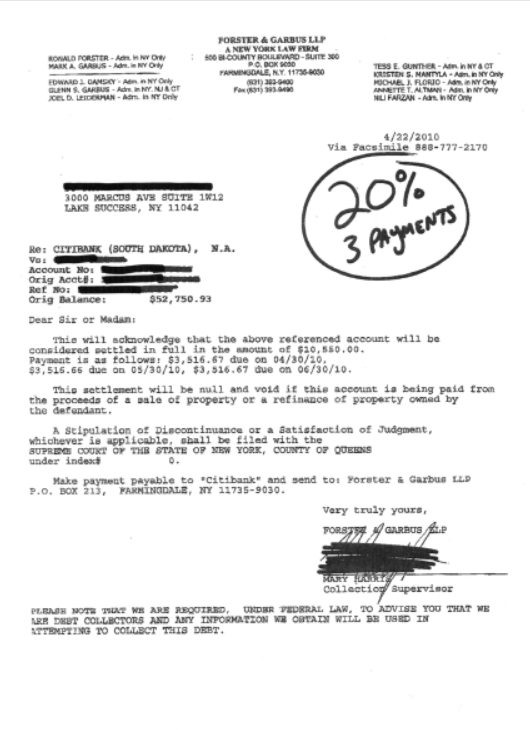

Negotiating your debt down to 50% or less than what you owe.

What are the effects on your everyday life?

Debt Settlement: What is it?

Debt Settlement: What is it?

Debt settlement refers to a financial agreement where a debtor negotiates with their creditor to pay off a portion of their total debt, in exchange for the debt being considered paid in full. This process typically involves the debtor making a lump-sum payment that is less than the full amount owed. Debt settlement is often used as a strategy to manage or reduce overwhelming debts and can affect the debtor’s credit score.

Who is a Good Candidate?

Anyone who is considering bankruptcy or has an inability to afford their monthly minimum payments and with the bulk of their debt being unsecured such as credit card debt, may be a good candidate for Debt Settlement. Debt Settlement is one of the cost effective ways to get out of debt without have the more severe effects of a bankruptcy. With debt settlement you have the ability to be flexible with your payments making a perfect solution for those who are having difficulty with the minimums.

The Debt Validate Difference.

Debt Validate has partnered with one of the biggest debt settlement firms in the country to provide the the best, most-flexible, cost effective programs in the industry. Debt Validate sets the table by validating your debt, and repairing your credit, then we tag our attorney firm in to bring it home. Its a perfectly coordinated effort, and incredibly effective.

A Process that Works!

Debt settlement is a process aimed at resolving debt by negotiating with creditors to pay a reduced amount of the outstanding debt. This is typically pursued when the debtor is unable to pay the full amount owed. Here’s a detailed look at how the process generally unfolds:

1. Assessment of Financial Situation:

The first step is to thoroughly assess the debtor’s financial situation. This involves reviewing income, expenses, debts, and understanding the severity of the financial hardship.

2. Do it yourself or Choose a Reputable company:

While individuals can negotiate with their creditors on their own, many choose to use a debt settlement company. These companies negotiate with creditors on behalf of the debtor to try to reduce the total debt.

3. Setting Aside Funds for Settlement:

Debtors typically make monthly payments into an account managed by the debt settlement company instead of paying their creditors. These funds accumulate over time and are eventually used to offer a lump-sum payment to the creditors.

4. Negotiation:

Once there is a substantial amount in the account, the debt settlement company begins negotiations with creditors. The goal is to agree on an amount significantly lower than the total debt owed, arguing that this lump-sum payment is the debtor’s best effort to pay back as much as possible.

5. Settlement Agreement:

If the creditor agrees to the proposed settlement amount, both parties will sign a settlement agreement. This legally binding document outlines the terms of the payment and the agreement that the debt will be considered resolved once the payment is made.

6. Making the Payment:

The debtor pays the agreed-upon amount to the creditor. This is typically done from the account where funds were accumulated.

7. Finalization:

Once the payment is received, the creditor marks the debt as settled. This is reported to credit bureaus, and the debtor’s credit report will reflect that the debt was settled for less than the full amount owed.

8. Impact on Credit Score:

It’s important to note that debt settlement can negatively impact the credit score, as the debts are not paid in full. However, for many, this is a preferable option compared to bankruptcy or continuing to accrue unmanageable debt.

Debt settlement can provide relief from overwhelming debt, but it’s important to consider the implications carefully, including potential fees from debt settlement companies and the impact on credit health..