Debt Validation

Debt Validation

Your Key to stopping Debt collectors, but what is it exactly?

Debt Validation

The Abstract:

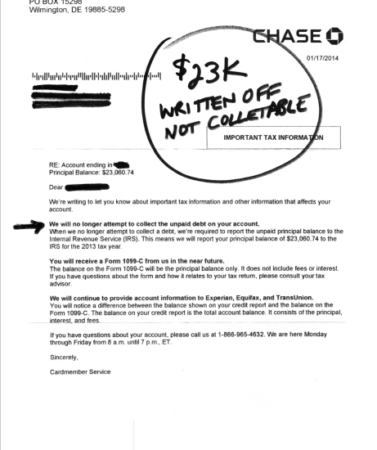

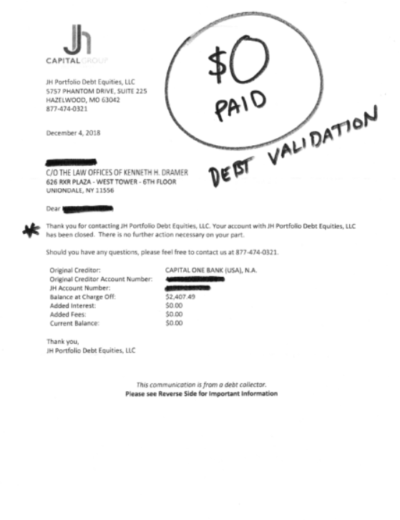

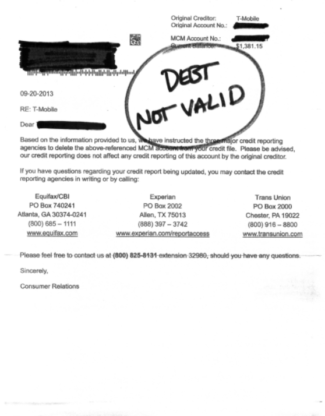

Debt Validation is the process by which a debtor requests, and a creditor is required to provide evidence that the debtor “legally” owes a specified debt.

This is a protection mechanism granted through the Fair Debt Collections Practices Act (FDCPA) that obliges the collector to furnish proof of the debt’s validity, including the amount owed and the creditor’s right to collect the debt, typically in response to a formal request from the debtor.

The right to collect can sometimes be sold to another company. This is know as a “debt purchaser” or “debt buyer”. This new company now has the right to collect what you owed the original creditor. However, when debt purchasers buy the rights to collect a debt, they very frequently do not acquire ALL the documentation necessary to PROVE that right to you, the debtor, thus the need for Debt Validation.

Proof that a Debt is VALID

Debt collection requires proof!

So why is this important? It’s important because whether you actually owe the money or not, the burden of proof is on the third party debt collector to PROVE that the debt is valid. The debt purchaser must show the amount they say you is accurate, then must provide all the documentation to prove they can legally collect. If they cannot, you may not have to pay.

What constitutes PROOF?

Under the Fair Debt Collections Practices Act (FDCPA), a Debt collector is REQUIRED to provide the following 4 things:

1. Documentation of Assignment OR Proof of Sale

2. Documentation that the debt is legally within the statute of limitations

3. The Debt Collector’s information is “accurate”.

4. A complete accounting of the alleged balance and how it was derived.

IF THEY ARE MISSING ANY OF THE ABOVE THE MUST INVALIDATE THE DEBT!

This Can’t Possibly Be for Real Right?

5 Laws that Invalidate Debt: Know Your Rights!

- Fair Debt Collections Practices Act (FDCPA): The Fair Debt Collection Practices Act (FDCPA) is a federal law enacted in 1977 designed to eliminate abusive, deceptive, and unfair debt collection practices. It provides guidelines under which debt collectors may conduct business, defines rights of consumers involved with debt collectors, and prescribes penalties and remedies for violations of the Act. The FDCPA applies to personal, family, and household debts, including money owed on personal credit card accounts, auto loans, medical bills, and mortgages. The Act restricts the means and methods by which collectors can contact debtors, as well as the times of day and frequency of contact. It also ensures that debt collectors maintain privacy, fairness, and respect towards debtors, and mandates clear disclosure about the debt and confirmation of its accuracy.

- Fair Credit Reporting Act (FCRA): The Fair Credit Reporting Act (FCRA) is a federal law established in 1970 to ensure the accuracy, fairness, and privacy of consumer information in the files of consumer reporting agencies. It governs how consumer credit information is collected, shared, and used. Key provisions of the FCRA include consumer rights to access and correct their credit reports, requirements for consumer consent before reports are provided to employers, and notifications to consumers when their credit information has adversely affected them. The act aims to protect consumer privacy and prevent identity theft.

- Truth in Lending Act (TILA): Is a federal law enacted in 1968 that aims to promote the informed use of consumer credit by requiring disclosures about its terms and cost. The law standardizes the manner in which borrowing costs are calculated and disclosed to consumers, enabling them to compare the terms of various loans and credit offerings more easily. TILA covers a wide range of credit transactions, including credit cards, mortgages, and personal loans. It mandates that lenders disclose key information such as interest rates, fees, the total cost of the loan, and any terms related to late fees and prepayment penalties. Additionally, TILA provides consumers with certain rights, including the right to rescind certain credit transactions that involve a lien on a consumer’s principal dwelling, and it regulates advertising related to consumer credit.

- Fair Credit Billing Act (FCBA): is a federal law enacted in 1974 to protect consumers from unfair billing practices. It allows consumers to dispute billing errors on their credit card and revolving credit accounts, such as unauthorized charges or charges for undelivered goods. The FCBA mandates that creditors must acknowledge disputes within 30 days and resolve them within two billing cycles, not exceeding 90 days. Additionally, it oversees the timely posting of payments and the management of credit balances, helping to ensure the accuracy and fairness of consumer credit billing.

- Credit Card Act of 2009: Also known as the Credit Card Accountability Responsibility and Disclosure Act, is a U.S. federal law that introduces significant consumer protections in the credit card industry. It imposes strict rules on credit card issuers, including limits on interest rate increases, enhanced disclosure of terms, and restrictions on fees. The Act also sets requirements for issuing credit cards to individuals under 21 and mandates that payments over the minimum are applied to the highest interest balances first. Designed to make credit card terms more transparent, the Act helps consumers make more informed financial decisions.